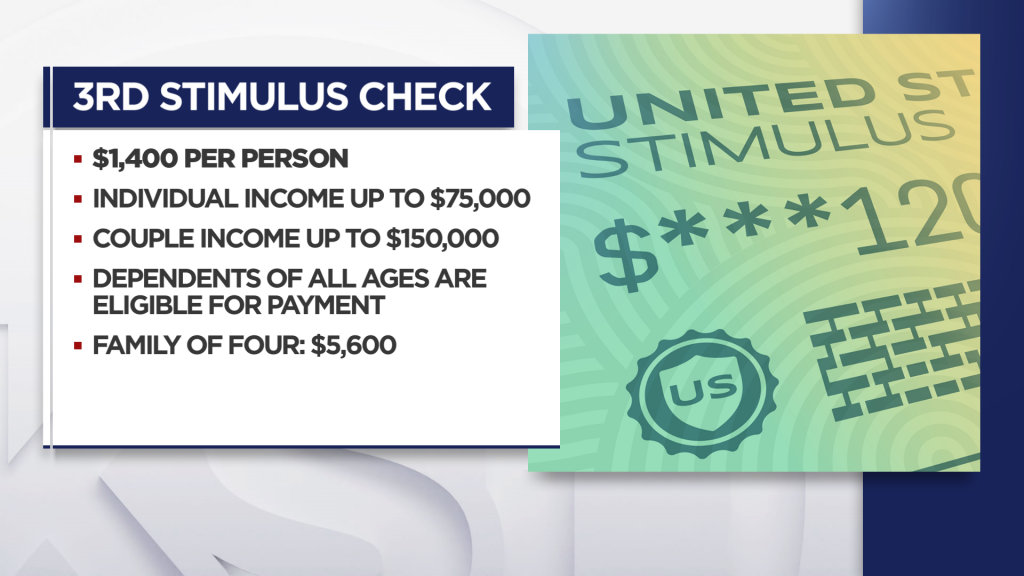

This includes someone who died in 2020, if you are preparing a return for that person.” resident alien, weren’t a dependent of another taxpayer, and have a valid social security number. “Generally, you are eligible to claim the recovery rebate credit if in 2020 you were a U.S. The instructions to the 2020 form 1040 state in part, The IRS appears to have adopted this position. The Appropriations Act actually indicates that only persons who died in 2019 or earlier are ineligible for payments. of a deceased individual who obtains possession of a payment sent for such deceased individual. The same is generally true under the CARES Act for an administrator or executor of an estate and for a family member, friend, attorney, agent, etc. A trustee of a trust that receives an economic impact payment in his or her capacity as a trustee should return the money. But a deceased individual is a separate taxpayer from his or her estate for the portion of the year that such individual was living.Īll three laws specifically exclude estates and trusts from the definition of “eligible individual”. Note: Estates and trusts are ineligible for these stimulus payments. There are numerous instances of checks being sent to deceased persons, with the recipients/holders of those checks being left with questions about what to do. In all three cases, the payments pursuant to such credits are accelerated so that individuals can receive the funds now. The payments under the CARES Act and Appropriations Act are actually tax credits to be claimed on 2020 tax returns (which will be filed in 2021), while the payments under the Rescue Plan Act are tax credits to be claimed on 2021 tax returns (which will be filed in 2022). Under the Rescue Plan Act, however, individuals with an AGI of $80,000 or more (or couples with an AGI of $160,000 or more) will not be eligible to receive any stimulus payments whatsoever under the Rescue Plan Act. For example, a single taxpayer with no qualifying children and with an AGI of $87,000 is considered “fully phased out.” In contrast, a single taxpayer with 2 qualifying children is “fully phased out” at AGI of $111,000. Under the CARES Act and the Appropriations Act, the payments are reduced by 5% of the amount that the taxpayer’s AGI exceeds $75,000 (or $150,000 for married filers). Under the Rescue Plan Act, payments are $1,400 to each eligible individual and $1,400 for each dependent of an eligible individual Such payments phase out based upon an individual’s Annual Gross Income (AGI) based on 2019 returns. The Appropriations Act provides direct payments of $600 per eligible individual, $1,200 for joint filers ( down from $1,200/$2,400 under CARES Act) and $600 per qualifying child ( up from $500 under CARES Act). The IRS has provided other methods for eligible individuals who did not file 2019 or 2020 tax returns to claim the payments.

Under the Rescue Plan Act, the payment amount is based on 2019 income, or 2020 income if the 2020 tax return has been filed. Under the CARES Act and the Appropriations Act, the payments are sent automatically to any eligible individual who filed a 2019 Federal income tax return. Who is Eligible?Īll three laws generally say that payments will be made to “eligible individuals.” An eligible individual is generally any U.S. In this article discuss how estates and trusts should handle these stimulus payments.

Irs gov 3rd stimulus check tracking how to#

One very common question is how to deal with the payments that are made to trusts and deceased persons. This is the third round of stimulus payments, with the first two rounds coming from the March 2020 Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) and the December 2020 Consolidated Appropriations Act (the “Appropriations Act”). Among many other things, The Rescue Plan Act provides “recovery rebates”, which are commonly referred to as economic impact payments (EIPs) or stimulus payments, to many taxpayers. On March 11, 2021, President Biden signed into law the American Rescue Plan Act of 2021 (the “Rescue Plan Act”).

Many people are continuing to struggle to make ends meet due to the COVID-19 pandemic and related business shut-downs.

0 kommentar(er)

0 kommentar(er)